Set-up and support

Acquiring all the moving parts is only one half of the equation. The other half is implementation, which can be a complicated process. Without the right skills to guide a successful deployment, security measures could be weakened and productivity could easily be compromised. If not done properly, businesses could be faced with one very expensive mess.

Given how new the IoT still is, it’s very possible that businesses won’t have the expertise they need in-house. In order to facilitate machine-to-machine communication, bandwidth requirements and costs need to be carefully considered.

A major benefit of subscription models is that the support needed can be built into the package. Instead of making a one-off purchase, the pay-monthly model fosters an ongoing relationship that includes assistance with set-up and activation. With implementation under control, businesses can put the IoT to work faster.

Financial flexibility

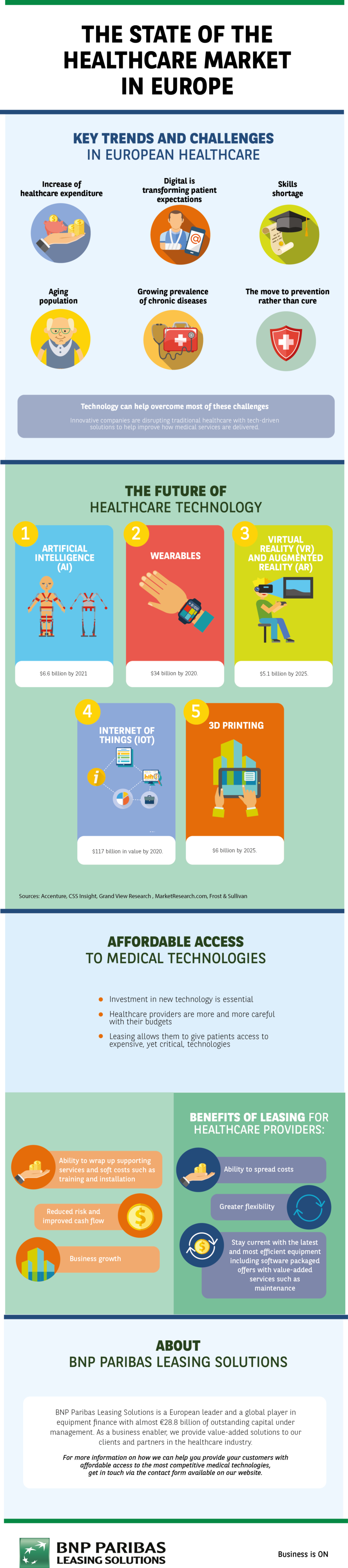

IoT implementation requires investment in some costly equipment which easily claims about 24% of IT budgets. When money is already tight, this kind of outlay is often not possible, and eats up cash that could be spent on growing the business in other ways. A leasing agreement with regular payments provides far greater flexibility and gives access to everything needed, including analytics, actuators, applications, and more.

A limited budget is no longer a barrier to creating a truly interoperable system. With the right finance, businesses can secure the equipment, software and support that they need.

Thinking ahead

Nothing lasts forever, least of all technology. The IoT itself is continually being improved to achieve better performance at lower costs. Investing in a bulk buy of sensors, for example, may not be such a good idea when you consider that scientists have already created an improved version with a longer-lasting battery. Businesses don’t want to be left behind but neither do they want to be burdened with expensive equipment that is obsolete before it has even started paying its way.

A different approach to financing technology can help keep businesses agile and up-to-date. One of the advantages of subscription and leasing models is that, after an agreed term, IT departments can upgrade their equipment without having to break the bank.

No matter how big or small the company size, the IoT presents huge benefits for all. The first step is for businesses to speak to their accountants and get them to review the available options. Every organisation has different needs so it’s crucial to know what sort of IoT deployment is best suited to the business. From there it’s possible to make a decision on the best way to finance the combination of software and hardware required.

The interconnected future is here and it offers untold rewards. It’s important that businesses have the best chance possible to get on-board with a well thought out IoT strategy.